Lead investor in over 50% of the most valuable startup semiconductor design IPOs globally over the last decade.

Alex first met Roger back in 1999 while running his startup. Alex then represented a Hong Kong family office to invest in IPV I in 2006. He joined IPV as an Entrepreneur in Residence back in 2009 and became a full-time Partner in 2010. Alex brings 20+ years of experience in venture capital and executive operations in the technology industry in China. Alex received a Bachelor of Commerce from McGill University and is currently serving as the Chairman of McGill University Asia Regional Advisory Group, and a member of the Desautels Faculty of Management International Advisory Board.

David met Tingru and Roger in 2003 and joined IPV Capital’s Advisory Board in 2006. In 2007, while at ComVentures, David was co-lead investor in SG Microelectronics and David joined IPV Capital full-time in 2015. David’s experience includes 20+ years as a venture capital investor at JPMorgan Partners, ComVentures and Gramercy. Earlier in his career, David was a technology investment banker for 10 years at Credit Suisse First Boston, Deutsche Morgan Grenfell and Lehman Brothers. David received a BA from the University of California, Berkeley, and an MBA from The Wharton School, University of Pennsylvania.

Roger joined Infotech in 2003 as its CIO. In 2006, along with Tingru, Roger co-founded Infotech’s Global investment vehicle IPV Capital. Roger led IPV Capital’s investments into a number of companies; Maxscend, SG Micro, GigaDevice, Senodia and Simgui (NSIG). Prior to Infotech and IPV Capital, Roger was a start-up executive, he served as President and COO of Codex Group (SoC semiconductor and Embedded Software) and VP/GM at CollabNet, (Enterprise Collaboration SASS). Earlier in his career, Roger held various international positions in technology sectors, including sales, marketing and corporate development. Roger received an MBA from the University of Wales, a Graduate Degree from Shanghai Academy of Social Sciences and an Executive Education from the Wharton School.

Tingru has 30 years of experience in global Venture Capital & Private Equity, operations and government affairs in China's technology industries. Tingru led IPV Capital’s investments into GigaDevice, SG Micro, NSIG, and Ingenic. Before founding Infotech, Tingru was Director of the Economic Policy Department and Secretary for Vice Minister at the Ministry of Information Industry (MII) and subsequently as Department Head of National Investment Corporation. Throughout the past 15 years Tingru has been instrumental in building Infotech/IPV into a leading Global Technology Venture Investment firm. Tingru received BSc from Peking University, he was also a visiting Scholar at Stanford University APARC program

Mok joined IPV Capital in 2011 as CFO and has held board membership positions in several IPV-backed companies including Tiandi Energy, V-Key and Giantec Semiconductor. He previously was a Group CFO for a renewable energy conglomerate at Shandong, China. Earlier in his career, Mok was a consultant for over 10 years at Arthur Andersen, Deloitte and Ernst & Young. Mok received a First Class Degree in Accounting from the University of Malaya, Malaysia and a CFA Charter holder as well as a fellow member of UK Association of Certificated Chartered Accountants.

Ning has over 30 years of experience in the global private equity and venture capital markets. He has held board membership positions in several IPV-backed companies including GigaDevice, Tongtech, iFlytek, and iSoftstone. Ning was previously a Senior Executive at China International Economic Consultants. He holds an MBA from China European International Business School, and a bachelor’s from Beijing Economics College.

Tom is IPV’s Venture Partner in Europe. He has been a close IPV affiliate since 2006 and invested personally in as well as directed clients’ capital to IPV’s funds. He has been involved in PE fund and direct investing for close to 20 years. Prior to his extensive investment activities in PE, he covered rapidly growing tech companies for Credit Suisse on the West Coast of the US for close to 10 years in the 90’s. Since 2016, Tom is head of business development and CFO of FlowGen Development & Management Ltd, based in Switzerland. It offers decentralized renewable energy solutions combining its proprietary hyper-efficient small wind turbines with solar and storage.

Wesley is an advisor to IPV and has been acquainted with Roger and Alex for over a decade. Wesley has been involved in the global private equity, M&A, and venture capital markets for over 15 years and he is currently the Chairman and Founding Partner of L&L Capital. Wesley has held several board membership positions at IPV-backed companies including Senodia and Simgui. He received an EMBA from China Europe International Business School and a BA in Economics from Renmin University.

Prior of returning to IPV Capital in 2021, Ms. Huang was in charge of compliance, risk control, and back office of Anchuang Capital. She was also responsible for various portfolio post-investment activities. Ms. Huang also once served as the vice president of IPV Capital, and was a member of the investment team and she began her private equity career with CID Group as analyst in its research institute, where she identified investment opportunities from top-down industry research. In addition to her VC experience, Ms. Huang was also a financial director of a core tech start-up company where she built a financial system, project budget system, and internal control system that path way for the company’s growth. Ms. Huang received her MBA in Finance from China Europe International Business School (CEIBS). She also holds a master degree in materials engineering from Shanghai Jiao Tong University.

Tiemin Zhao's extensive experience in R&D and operations within the semiconductor industry has been invaluable to IPV. Tiemin is one of the foremost authorities on semiconductor technology in the world. As an advisor turned team member, Tiemin has played a key role in the success of several startups. He holds a PhD EE from Stanford University and has served on the boards of three startups, contributing to two profitable exits.

Tingru has 30 years of experience in global Venture Capital & Private Equity, operations and government affairs in China's technology industries. Tingru led IPV Capital’s investments into GigaDevice, SG Micro, NSIG, and Ingenic. Before founding Infotech, Tingru was Director of the Economic Policy Department and Secretary for Vice Minister at the Ministry of Information Industry (MII) and subsequently as Department Head of National Investment Corporation. Throughout the past 15 years Tingru has been instrumental in building Infotech/IPV into a leading Global Technology Venture Investment firm. Tingru received BSc from Peking University, he was also a visiting Scholar at Stanford University APARC program

Roger joined Infotech in 2003 as its CIO. In 2006, along with Tingru, Roger co-founded Infotech’s Global investment vehicle IPV Capital. Roger led IPV Capital’s investments into a number of companies; Maxscend, SG Micro, GigaDevice, Senodia and Simgui (NSIG). Prior to Infotech and IPV Capital, Roger was a start-up executive, he served as President and COO of Codex Group (SoC semiconductor and Embedded Software) and VP/GM at CollabNet, (Enterprise Collaboration SASS). Earlier in his career, Roger held various international positions in technology sectors, including sales, marketing and corporate development. Roger received an MBA from the University of Wales, a Graduate Degree from Shanghai Academy of Social Sciences and an Executive Education from the Wharton School.

Terence has been with IPV Capital since 2006 and is a Managing Partner on IPV Capital I & II. Terence has held board memberships with several IPV-backed companies including Amprius, Giantec Semiconductor, K-Vision, and V-Key. He was previously the Head of Asia at Worldview Technology Partners. Terence received an MBA from Oklahoma City University and a bachelor’s in engineering from the National University of Singapore.

Ning has over 30 years of experience in the global private equity and venture capital markets. He has held board membership positions in several IPV-backed companies including GigaDevice, Tongtech, iFlytek, and iSoftstone. Ning was previously a Senior Executive at China International Economic Consultants. He holds an MBA from China European International Business School, and a bachelor’s from Beijing Economics College.

Alex first met Roger back in 1999 while running his startup. Alex then represented a Hong Kong family office to invest in IPV I in 2006. He joined IPV as an Entrepreneur in Residence back in 2009 and became a full-time Partner in 2010. Alex brings 20+ years of experience in venture capital and executive operations in the technology industry in China. Alex received a Bachelor of Commerce from McGill University and is currently serving as the Chairman of McGill University Asia Regional Advisory Group, and a member of the Desautels Faculty of Management International Advisory Board.

Mok joined IPV Capital in 2011 as CFO and has held board membership positions in several IPV-backed companies including Tiandi Energy, V-Key and Giantec Semiconductor. He previously was a Group CFO for a renewable energy conglomerate at Shandong, China. Earlier in his career, Mok was a consultant for over 10 years at Arthur Andersen, Deloitte and Ernst & Young. Mok received a First Class Degree in Accounting from the University of Malaya, Malaysia and a CFA Charter holder as well as a fellow member of UK Association of Certificated Chartered Accountants.

Tiemin Zhao's extensive experience in R&D and operations within the semiconductor industry has been invaluable to IPV. Tiemin is one of the foremost authorities on semiconductor technology in the world. As an advisor turned team member, Tiemin has played a key role in the success of several startups. He holds a PhD EE from Stanford University and has served on the boards of three startups, contributing to two profitable exits.

Maxscend (SZSE:300782) is the leading RF company for mobile applications in Asia.

SG Micro (SZSE:300661) is China's leading high performance analog fabless design company.

GigaDevice (SHSE:603986) is the leading company of NVM devices and advanced memory in China

Giantec (SHSE:688123) is one of the largest EPROM semiconductor companies globally.

Vimicro (formerly NasdaqGM:VIMC) is the leading video technology company in China.

iSoftStone (formerly NYSE:ISS) is a leading IT service company in China.

Ingenic (SZSE:300223) is a leading industrial semiconductor company in China.

TSHT (SZSE:002185) is the leading semiconductor testing packaging company in China.

TongTech (SZSE:300379) is a leading middleware enterprise solution company in China.

Vobile (SEHK:3738) offers a leading mobile security solution.

Q Tech is a leading 3D semiconductor packaging company globally. Q Tech sold to TSHT.

Senodia is the leading MEMS semiconductor company in China.

NSIG (SHSE:688126) is the leading silicon-based semiconductor materials company in China.

Amprius is a leading nanotech lithium battery materials and battery company.

GrandMetals is one of the top three producers of semiconductor PCB boards.

On November 24, 2021, Beijing — GigaDevice, an industry-leading semiconductor supplier (stock number 603986), officially launched the latest member of its Arm® Cortex®-M33 core MCU portfolio, the GD32W515 series of Wi-Fi microcontrollers.

This brand new MCU family has leading baseband and RF performance, built-in TrustZone architecture to create a reliable hardware execution environment for secure data storage, and continues the perfect compatibility of software and hardware in the GD32 MCU family. The GD32W515 series products provide wireless connectivity development options for various application needs such as smart home, industrial IoT, and consumer electronics. With the enhanced processing capabilities and rich integration features, such designs are greatly simplified. Samples are now available and will be officially mass-produced in December.

GD32W515 Series Cortex®-M33 Wi-Fi MCU

The GD32W515 series of MCUs continue to use the latest Arm® Cortex®-M33 core, integrated with a 2.4GHz single-stream IEEE802.11b/g/n MAC/Baseband/RF radio frequency module on-chip. The Cortex®-M33 core is based on the new Armv8-M instruction set architecture and supports the DSP instruction extension and single-precision floating-point arithmetic unit (FPU). The included optional TrustZone hardware security mechanism supports independent storage access space, enhancing the security and flexibility of such applications.

The wireless GD32W515 series has a maximum transmit power of 21 dBm, a signal receiving sensitivity of -97.6 dBm, and a total link budget of 118.6 dBm to provide leading class baseband and radio frequency performance. It also has a superior anti-interference ability. The adjacent channel rejection (ACR) value is as high as 48dB, which can effectively prevent strong signal interference and improve the stability of signal reception. This series of MCU supports high transmission rates with Iperf throughput of up to 50Mbps, and in laboratory test conditions, the throughput reached up to 80Mbps. The radiofrequency (RF) module is fully integrated on-chip to simplify designs, effectively reducing the number of external components and thus saving BOM costs.

The GD32W515 series MCU provides a maximum frequency of 180MHz, up to 2048KB of on-chip Flash, 448KB of SRAM, and supports up to 32MB of external Flash. The power supply voltage is 1.6-3.6V, while the I/O ports can withstand 5V voltage levels. The standard industrial temperature range of –40 to +85°C is supported as well.

The chip has built-in rich peripheral resources including one 12-bit ADC, four general-purpose 16-bit timers, two general-purpose 32-bit timers, one basic timer, one PWM advanced timer, and a series of communication interfaces: up to two SPIs, one SDIO, two I2Cs, three USARTs, one I2S, USB2.0 FS, and Wi-Fi wireless interface. Other peripherals include TrustZone control unit (TZPCU), digital camera interface (DCI), touch sensing interface (TSI), Quad SPI Flash Interface (QSPI), and a new High-performance Digital Filter (HPDF). It can be used for external Σ-Δ modulation to achieve high-precision audio signal processing.

GD32W515 Series MCU Portfolio

Benefiting from the system isolation features provided by the TrustZone hardware security architecture, the new MCU can support the secure startup from the secure area and provide services such as secure storage, initialization authentication, and security logging at the application level. It enhances the protection of confidential code and data, core processes, and critical peripheral equipment. It also supports the brand-new security features stipulated by the Wi-Fi protocol, such as WPA3 and the management frame protection function. The confidentiality and security of the communication process in the end device are no longer compromised.

The GD32W515 series of MCUs have officially passed the PSA Level 1, PSA Functional API certification of the Arm platform security architecture to provide higher security. It has also passed Wi-Fi certification authorized by the Wi-Fi Alliance (WFA) and RF FCC/CE compliance certification. It has excellent compatibility with wireless routers (APs) from many manufacturers and can quickly establish connections.

The GD32W515 series of MCUs is supported by a complete set of development kits. In addition to the documentation and firmware library, the software development kit (SDK), which includes hardware drivers, software protocol stacks, cloud connections, and other functions dedicated to Wi-Fi modules, is also available. Various development environments and tools such as Keil MDK, IAR EWARM, and GCC are fully supported. Embedded operating systems such as FreeRTOS, µCOS, RT-Thread, and AliOS Things have been ported, and available Wi-Fi reference design solutions can be provided as well.

Mr. Eric Jin, Product Marketing Director of GigaDevice, said, “We will expand a wider variety of wireless MCU product portfolios to provide innovative shortcuts for the endless development needs in the AIoT era. With the excellent processing performance and accelerator of the Cortex®-M33 core, the new Wi-Fi MCU can support edge computing such as local voice recognition, keyword wake-up, and artificial intelligence algorithms such as TinyML. The TrustZone security architecture can also greatly improve the information security design of IoT devices, escorting users’ privacy and security in the era of big data with Internet of Everything.”

Dedicated development boards for the GD32W515 series have been launched simultaneously. The GD32W515P-EVAL full-featured evaluation board, which is based on the QFN56 package, supports development, debugging, and complete function demonstration. The GD32W515T-START entry-level kit, which is based on the QFN36 package, can be used to evaluate Wi-Fi-related development. For further information, please contact your local GigaDevice Sales Office or authorized representative.

GigaDevice GD32 MCU is a leader in China’s high-performance 32-bit general-purpose microcontroller market being the first to release China’s Arm® Cortex®-M3, Cortex®-M4, Cortex®-M23, and Cortex®-M33 core MCU product series. GigaDevice is also the first company to launch the RISC-V core general-purpose 32-bit MCU product series in the world. GD32 series MCUs have become the mainstream choice for China’s 32-bit general-purpose MCU market. With more than 800 million units shipped, more than 20,000 customers, and 34 series with more than 400 part numbers, GigaDevice can provide solutions for a breadth of applications and rank among the forefront of the market.

GigaDevice GD32 MCU is also the first Chinese Arm® University Program (AUP) partner, an Arm® Mbed™ IoT platform eco-partner, and the title sponsor of the “GigaDevice Cup” in China Graduate Electronics Design Competition. GD32 aims to build a blueprint for planning and to develop an “MCU Department Store” to provide users with the most comprehensive system-level product and solution support, build an intelligent development platform, and a complete product application ecosystem. For more information, please visit www.GD32MCU.com.

On October 29, 2021, Beijing — GigaDevice, an industry-leading semiconductor supplier (stock number 603986), officially launched the latest member of its Arm® Cortex®-M23 core MCU portfolio, the GD32L233 series of mainstream low-power microcontrollers.

The GD32L233 series of MCUs provide excellent power consumption efficiency and optimized processing performance with multiple operating and sleep modes. Compared with similar low-power MCU products in the industry, it has richer peripheral resources and application flexibility, therefore paving the way for continuous optimization of system-level power consumption. The new series can be widely used in typical markets ranging from industrial meters, small consumer electronic devices, portable medical equipment, battery management systems, data acquisition, and transmission. The GD32L233 series of MCUs are available in 10 part numbers supporting package options of QFN32, LQFP32, LQFP48, and LQFP64. Samples and development boards are now available and will be officially mass-produced and supplied in November.

GD32L233 Series Cortex®-M23 Low-power MCU

The concept of low power consumption runs through the entire chip design process at multiple levels, such as the evolution of manufacturing processes, the development of design concepts, and the innovation of chip architecture. The new GD32L233 low-power series of MCU products can effectively optimize the system power consumption:

The GD32L233 series MCU supports a system frequency of up to 64MHz, 64KB to 256KB embedded eFlash, 16KB to 32KB SRAM, and various enhanced I/O and peripheral resources connected to two APB buses. The series continues to use the industry-leading Arm® Cortex®-M23 core and brings high-efficiency processing capabilities through the reduced yet powerful Armv8-M instruction set. The fully optimized bus design, which supports independent multipliers and dividers, helps further embedded applications for low power consumption and high-efficiency energy saving.

The GD32L233 series of MCUs achieve excellent power consumption efficiency. The deep-sleep current is reduced to 2µA, with the wake-up time achieving less than 10µs. And the standby current is as low as 0.4µA. Various system clocks can trigger the deep sleep mode, and peripheral interfaces support multiple wake-up sources, including a Low-power Timer, Low-power UART, RTC, LCD, standard I2C, USART, etc. The MCU operates from 1.7V to 3.6V and supports a battery (Vbat) power supply. The brand-new designed power management unit provides up to six low-power modes, including partial sleep, deep sleep, external wake-up, etc. Under the maximum frequency and full-speed active mode, the power consumption is only 66µA/MHz, which proves excellent energy efficiency. Flexible power supply modes can achieve lower average power consumption and extend battery life.

The new MCU is equipped with a wealth of peripheral interfaces to enhance connectivity, and the GPIO multiplexing rate is as high as 93%. Compared with equivalent low-power MCUs in the market, the GD32L233 series has more available I/O resources in the same package. Excluding the power supply, the remaining I/O interfaces can be used to configure more functions which significantly enhances usage flexibility.

The GD32L233 series of MCUs provides up to four general-purpose 16-bit timers, two basic timers, and one 32-bit low-power timer. Standard and advanced communication interfaces: up to two USARTs, two UARTs, a Low-power LPUART, three I2Cs, two SPIs, an I2S, and a USB 2.0 FS controller are also supported. Furthermore, the 32-bit Low-power Timer and Low-power UART can run in partial Deep-Sleep mode and wake up the MCU. In terms of analog peripherals, it integrates an ADC with a 12-bit sampling rate of up to 1MSPS, a 12-bit DAC, and two comparators.

The GD32L233 MCU introduces a new multi-channel DMA selector module (DMAMUX), which increases routing flexibility between peripherals and DMA. Through self-configuration, DMA functionality can be provided for almost all peripherals. The MCU integrates a full-featured calendar RTC, programmable voltage detector (PVD), and a programmable brown-out reset (BOR), which can monitor battery power and voltage abnormalities then wake up the MCU. It also supports an LCD segment controller, which provides 8*28 segments and 4*32 segments in two formats. It also integrates a high-precision temperature sensor with an accuracy of ±0.5°C, which is especially suitable for developing portable personal health monitoring equipment such as oximeters, blood pressure meters, and environmental monitoring sensors.

GD32L233 Series MCU Portfolio

GD32L233 Series MCU Portfolio

Mr. Eric Jin, Product Marketing Director of GigaDevice, said, “The new GD32L233 series of mainstream microcontrollers provide more development options for energy efficiency-sensitive industry customers. The booming market demand is the driving force behind the continuous development of the GD32 MCU family. We continue to enhance performance, power consumption, and cost advantages and extend our low-power design concepts to power management, signal chain, and multi-protocol wireless connectivity chips. Smart application devices that have demanding power consumption requirements will benefit from the GD32L series of MCUs.”

The development boards based on GD32L233 have been launched simultaneously, including the GD32L233R-EVAL full-featured evaluation board, the GD32L233C-START, and GD32L233K-START entry-level learning boards. These correspond to different package types to support simpler application development and debugging. For further information, please contact your local GigaDevice Sales Office or authorized representatives. Deliverables, including documentation and software support tools, can be found at www.GD32MCU.com.

GigaDevice GD32 MCU is a leader in China’s high-performance 32-bit general-purpose microcontroller market being the first to release China’s Arm® Cortex®-M3, Cortex®-M4, Cortex®-M23, and Cortex®-M33 core MCU product series. GigaDevice is also the first company to launch the RISC-V core general-purpose 32-bit MCU product series in the world. GD32 series MCUs have become the mainstream choice for China’s 32-bit general-purpose MCU market. With more than 800 million units shipped, more than 20,000 customers, and 29 series with more than 400 part numbers, GigaDevice can provide solutions for a breadth of applications and rank among the forefront of the market.

GigaDevice GD32 MCU is also the first Chinese Arm® University Program (AUP) partner, an Arm® Mbed™ IoT platform eco-partner, and the title sponsor of the “GigaDevice Cup” in China Graduate Electronics Design Competition. GD32 aims to build a blueprint for planning and developing an “MCU Department Store,” to provide users with the most comprehensive system-level product and solution support, build an intelligent development platform and a complete product application ecosystem. For more information, please visit www.GD32MCU.com.

SGMICRO won "China TOP 10 IC Companies" award

2021-03-19

NoneNextReturn list

On March 18, 2021, ASPENCORE, a leading global media group in the field of electronic technology, held the "China IC leader summit 2021 and China IC design achievement award ceremony" in Shanghai.

"China IC Design Award" is one of the most popular technical awards in the electronics industry. It has become an annual gathering of semiconductor industry leaders. 64 awards from four categories were presented, representing the highest standards of the industry, through a fair and impartial vote of electronics engineers, senior analysts and semiconductor industry insiders.

In 2022, SGMICRO will continue to take the market as the guidance, driven by innovation, insist on independent research and development, introduce more with the international advanced level of high performance, high quality analog IC products, to strengthen and expand the traditional electronics market at the same time, the power of things, intelligent, and the rapid development of emerging applications such as 5G, simulation chip industry efforts to become the world first-class brand.

Q Technology - Company News (qtechglobal.com)

Kunshan QTech Microelectronics Co., Ltd. ("Kunshan QT China"), a wholly owned subsidiary of Q Technology (Group) Co., Ltd. ("Q Technology" or the "Company"), obtained government rewards and subsidies for key transformation projects to intellectualization and digitalization Kunshan City, of which fully demonstrates the municipal party committee and government's determination to promote the deep transformation of industrial development.

In order to thoroughly study and implement president Xi Jinping’s important expositions on digital China and cultural industries, and vigorously promote the high-quality development of the digital economy and cultural industries, the Kunshan municipal government provides special subsidies to five benchmark intelligent manufacturing industries to help building Kunshan city as a benchmark city for the modernization socialism.

Q Technology has dedicated in developing automated production, intelligence production and implemented substantial production transformation and upgrade. The Company will stick to the mission of “equipping machine with a better vision than human’s eyes”. Through the building up of three capabilities: optical, computational and deep learning algorithm and system integrating capability, we are dedicated to providing machine vision and human vision solutions to portable smart devices. This award is an appreciate of the efforts of Q Technology putting in intelligence production. The team of Q Technology will treasure it and work even better going forward.

Q Technology - Company News (qtechglobal.com)

(January 2021) Q Technology (Group) Co., Ltd. (“Q Technology" or the "Company", together with its subsidiaries, collectively referred to as the "Group"," a supplier of intelligent vision modules for smartphones, vehicles and IoT terminals (HK Stock Exchange stock code: 01478) is pleased to announce that its subsidiary Kunshan Q Technology Co., Ltd. ("Kunshan QT China") has won the "Excellent Quality Award" of 2020 by the world-renowned robots product manufacturer ECOVAS

Since the cooperation between the Group and ECOVAS, AI camera module products have always been the key projects between the two parties. Since the outbreak of the COVID 19 pandemic in early 2020, the Group has faced various production challenges. However, the Group has managed to meet the rising demand of customer with timeliness delivery schedule and on the other hand, maintains stringent quality control and achieves the gold standard of 100% product delivered yield rate throughout the year. Therefore, we successfully won this important award and recognition from ECOVAS.

Mr. He Ningning, Chairman of the Board of Q Technology, said: "ECOVAS is a world-renowned robot brand. Over the past few years, Q Technology has grown up with ECOVAS and works as important partners. Granting this award to us represents ECOVAS recognition of the Company’s product quality and comprehensive services. In the future, Q Technology will continue to take "Illuminate Machines" as its vision and committed to provide high-quality intelligent vision integration solutions to terminals of Internet of Things and honor the trust from our customers.

The complete development toolchain IAR Embedded Workbench delivers support for the entire lineup of GigaDevice's GD32 series of Arm Cortex-M MCUs

Dec 03, 2020, 03:15 ET

UPPSALA, Sweden, Dec. 3, 2020 /PRNewswire/ -- Systems®, the future-proof supplier of software tools and services for embedded development, and GigaDevice, an industry-leading semiconductor supplier, announced their powerful solutions for GD32 Arm-based microcontrollers (MCUs). In June 2020, IAR Systems and GigaDevice announced their partnership for RISC-V. This partnership is now extended into delivering development tools for Arm® Cortex®-M3, Cortex-M4, Cortex-M23 and Cortex-M33 MCUs, enabling high-quality embedded applications for a wide range of industries.

GigaDevice's GD32™ family of high-performance, low-power, and cost-effective universal microcontrollers are powered by the Arm Cortex-M3, Cortex-M4, Cortex-M23 and Cortex-M33 cores. The GD32 MCU product family incorporates GigaDevice's advanced patented gFlash memory technology, providing extended functionality and design flexibility. The complete development toolchain IAR Embedded Workbench® for Arm provides developers with everything they need in one easy-to-use integrated development environment. The toolchain offers extensive debugging and analysis possibilities such as complex code and data breakpoints, runtime stack analysis, call stack visualization, code coverage analysis and integrated monitoring of power consumption. To ensure code quality, the static code analysis tool C-STAT and the runtime analysis tool C-RUN are integrated. In addition, IAR Systems provides excellent worldwide technical support and training.

"We see a huge interest for GigaDevice's GD32 MCUs thanks to our stable and consistent offering, and the fact that our customers are now able to use IAR Embedded Workbench for Arm is a major step forward in maximizing the performance of the MCUs," said Eric Jin, Product Marketing Director, GigaDevice. "Thanks to the partnership with IAR Systems, we ensure our customer access to not only high-performance, cost-effective microcontrollers, but also tools that make our microcontrollers perform at their best."

"We are happy to extend our renowned development tools for Arm with support for GigaDevice's GD32 Arm Cortex-M MCUs," said Anders Holmberg, General Manager Embedded Development Tools, IAR Systems. "GigaDevice is becoming an increasingly more important player in the embedded industry and we are working close together to ensure powerful and flexible solutions on a broad scale covering both RISC-V and Arm-based applications."

Support for GigaDevice GD32 Arm MCUs is available in latest version of IAR Embedded Workbench for Arm, version 8.50.9. More information is available at www.iar.com/gigadevice.

Editor's Note: IAR Systems, IAR Embedded Workbench, Embedded Trust, C-Trust, C-SPY, C-RUN, C-STAT, IAR Visual State, IAR KickStart Kit, I-jet, I-jet Trace, I-scope, IAR Academy, IAR, and the logotype of IAR Systems are trademarks or registered trademarks owned by IAR Systems AB. All other product names are trademarks of their respective owners.

IAR Systems Contacts

AnnaMaria Tahlén

Content & Media Relations Manager

IAR Systems

Tel: +46 18 16 78 00

Email: annamaria.tahlen@iar.com

Tora Fridholm

CMO

IAR Systems

Tel: +46 18 16 78 00

Email: tora.fridholm@iar.com

GigaDevice Semiconductor Contacts

Shaun Fong

Director of Marketing

GigaDevice

Tel: +1-408-855-8336

Email: shaun.fong@gigadevice.com

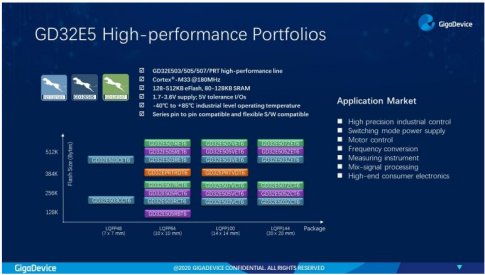

Beijing, China – (July 28, 2020) – GigaDevice, an industry leading semiconductor supplier (stock number 603986), officially released the brand new GD32E5 series of high-performance microcontrollers based on the new Arm® Cortex®-M33 core. This new series of MCUs are manufactured using TSMC’s Low Power 40-nanometer (40nm) embedded flash memory process, helping to improve power efficiency and development costs. The new MCU series continue to expand the current portfolio, aimed for embedded systems. These are well suited for the development of high-precision industrial control as well as digital power supply, motor frequency conversion, measuring instruments, mixed signal processing and industrial / consumer control. The GD32E5 product portfolio includes 3 general-purpose series and 1 special-purpose series, 4 package types and 23 product models. The series is currently sampling and will officially move to mass production next month.

GD32E5 product series general-purpose MCUs utilizing the Cortex®-M33 Core

New core and hardware accelerator improve processing performance

The GD32E5 series is based on the Cortex®-M33 core from the latest Armv8-M architecture. System frequency supports up to 180MHz, includes a built-in hardware multiplier/divider, DSP instruction set and single-precision floating-point unit (FPU). It is also equipped with a new hardware trigonometric math unit (TMU) that supports vector, sine and cosine, exponent, square root, common logarithm and other mathematical trigonometric operations, reducing the burden on the CPU and improving the processing efficiency. These advance features will benefit advanced computing applications centered on digital signal processing. The new GD32E5 series provides the highest performance at 244DMIPS and its CoreMark® test can reach 547 points. Compared with similar Cortex®-M4 products in the market, the code execution efficiency under the same main system frequency is improved by 10%-20% and compared with similar Cortex®-M23 products, the performance has been improved by more than 40%.

GD32E5 is equipped with 128KB to 512KB of Flash and 80KB to 128KB of SRAM. The dual-bank embedded flash memory allows simultaneous read and write operations. Additionally, it has a built-in memory protection unit (MPU) for task isolation, improving system’s reliability. The chip can be powered by 1.7V-3.6V power supply and the I/O port can support 5V voltage levels. Furthermore, the built-in power management unit is further optimized providing 5 power-saving modes. The operating current of the MCU, with all peripherals enabled and in full-speed operation mode is only 332µA/MHz, which is 32% lower than the current GD32F4 Arm Cortex®-M4 based MCUs. Also, the minimum standby current, powered by an external battery, is only 0.7µA.

Outstanding high-precision timer and mixed signal integration

GD32E5 now introduces, for the first time, a built-in super high resolution timer (SHRTimer). It includes 5 independent counters which can generate 5 groups of 2 PWM control signals supporting dead time complementary output and the signal’s frequency can reach up to 11.5GHz with highest resolution of 90ps. Due to its advance integration with other peripherals, this allows to generate various high-frequency waveforms for applications such as switching power supplies and motor control.

The analog components of the GD32E5 also adopt a highly integrated new design. In order to provide accurate analog measurement, the new chip integrates three 12-bit high-performance ADCs with a sampling rate of 2.6MSPS which supports fully differential inputs, up to 21 channels and supports 16-bit hardware oversampling with configurable resolution and filtering function. The actual effective number of bits and its linearity are also significantly improved compared to similar products in the market. Additionally, it provides two 12-bit DACs and three ultra-fast comparators with a propagation delay of 22ns.

Rich peripheral interfaces fully assist the industrial Internet

The GD32E5 introduces a brand-new USB 2.0 OTG dual-function controller. The built-in hardware PHY provides a variety of operating rates for design flexibility, including 480Mbps high-speed (HS) mode and 12Mbps full-speed (FS) mode. It also supports Device, HOST, OTG and other operating modes, while it supports crystal-less design with independent 480MHz PLL to reduce the usage cost. It is currently passing relevant certifications to ensure the compliance with USB-IF design standards.

The newly added SQPI controller supports serial, two-wire and four-wire interface for external memories such as SQPI Flash and SQPI PSRAM. Thereby, easily expanding its external memory resources making it suitable for mobile printers, display screens fingerprint recognition, OTA upgrades and other applications that require large RAM buffers. Moreover, the new GD32EPRT special-purpose series now integrates 4MB of PSRAM.

In order to realize a wide range of embedded control type applications, the GD32E5 is equipped with rich standard peripheral resources: up to nine 16-bit general-purpose timers, two 16-bit advanced vector control timers, one 32-bit general-purpose timer, two 16-bit basic timers and two multi-channel DMA controllers. The communication interface includes six UART, three SPI, three I2C, two I2S and one SDIO. It also integrates three CAN-FD (flexible data-rate) interfaces for CAN bus network, with the highest data rate reaching 6Mb/s and one 10/100M adaptive fast Ethernet controller (MAC), which can assist in the development of real-time applications with Ethernet connectivity.

The new MCU has 6KV electrostatic protection (ESD) capabilities and uses clock spread spectrum technology to reduce electromagnetic interference (EMI) of high-speed digital systems, while at the same time it completely complies with industrial-grade high reliability and temperature standards. The GD32E5 series of MCUs include 4 product series and 23 product models, including GD32E503, GD32E505, GD32E507 and GD32EPRT. All series are upwards binary compatible in the software model and share the same pin layout for the particular package type, thus providing great flexibility and releasing the great potential of the Cortex®-M33 core.

GD32E5 series of general-purpose Cortex®-M33 based MCUs New Features

GigaDevice adopts TSMC’s 40-nanometer low-power process to create an advanced microcontroller development platform, with industry-leading energy consumption ratio and high integration. It can help the industry to upgrade at a more economical cost price and further consolidate the leading position of the GD32 MCU family in the embedded microcontroller market. Eric Jin, Product Marketing Director of GigaDevice says: “As China’s first Arm® Cortex®-M33 core general-purpose MCU, and joining hands with TSMC, we launched the GD32E5 series high-performance new products, providing a cost-effective solution for high-precision industrial control and consumer applications with data-intensive, algorithm-intensive and communication-intensive requirements. We continue to support and expand the GD32 ecosystem, deepen in the market and industry needs, and enhance the user development experiences.”

About GD32 MCU

GigaDevice GD32 MCU is a leader in China’s high-performance 32-bit general-purpose microcontroller market being the first to release China’s Arm® Cortex®-M3, Cortex®-M4, Cortex®-M23 and Cortex®-M33 core MCU product series. GD32 series MCUs have become the mainstream choice for China’s 32-bit general-purpose MCU market. With a total of more than more than 400 million units shipped, more than 20,000 customers and 27 series with more than 360 part number selections, GigaDevice can provide solutions for a broad set of applications on the forefront of the market. GigaDevice GD32 MCU is also the first Chinese Arm® University Program (AUP) partner, an Arm® mbed™ IoT platform eco-partner, and the title sponsor of the “GigaDevice Cup” in China Graduate Electronic Design Contest. All models are compatible with each other in terms of software with scalable lines of hardware pin packages. They are fully applicable to all kinds of high-performance, mainstream and entry-level embedded control requirements, enabling cost-effective value while providing a comprehensive ecosystem and ease of use. More information please visit website GD32MCU.com.

Beijing, China – June 2, 2020 – GigaDevice, a leading provider of non-volatile memory, 32-bit microcontroller (MCU) and sensor solutions, today announced that it has launched an embedded cloud platform together with Amazon Web Services (AWS) bringing the global coverage and well established operating experiences of AWS cloud services to GD32 MCU developers. Effective immediately, GD32 MCU developers can use FreeRTOS to quickly access AWS. As part of the cooperation between the two parties, AWS has published the GD32 MCU-based device certification on the AWS partner device catalog, while all the necessary documents and code can be freely downloaded from the open source hosting website GitHub. AWS credits are also offered to users for evaluation purpose and are subject to availability.

New technologies such as 5G, big data, cloud computing and Internet of Things are rapidly being integrated into people’s daily life. The world is also accelerating the construction of digital infrastructure represented by artificial intelligence, data centers, industrial communication, Internet of Things and cloud computing. Amazon Web Services Cloud (AWS) is the pioneer and leader of global cloud computing, providing businesses and individuals with computing power, database storage, content delivery and other services.

AWS has millions of customers around the world, with an operating income exceeding US $35 billion in 2019. According to data from Synergy Research Group, an authoritative US market research organization, Amazon Cloud Services continues to maintain its leading position with a 33% market share, whilst AWS cloud infrastructure covers almost the whole world with 210 edge stations around the world, distributed in 78 cities across 37 countries. The number of cloud services provided by AWS exceeds 175 units, covering the fields of computing, storage, databases, networks, large data analysis, robotics, machine learning, artificial intelligence, Internet of Things, security, virtual reality, augmented reality, media (audio and video), satellite and 19 other categories including quantum technology.

The Director of business development of manufacture and retail, Amazon AWS in northern China, Harry Han, said: “I am very pleased to be able to go along together with GD32 MCU. At present, the cooperation between the two parties has a very good start. We will continue to promote and coordinate internal resources so that we closely connect the AWS and GD32 technical teams to ensure the highest quality services for our users. It will also actively expand upstream and downstream industries and ecological cooperation, jointly launch a series of Internet of Things solutions for terminal application-oriented smart parks, new energy control, digital agriculture and smart homes.”

GigaDevice product marketing director, Eric Jin, said: “GigaDevice, as a leader in the Chinese MCU market, is constantly enriching the product development and application ecosystem. With Amazon AWS, GigaDevice continues to provide industry-leading technologies and services by launching a new embedded cloud platform which can help all the GD32 developers to connect to AWS easily, quickly and securely. The users can easily create any IoT application and configure all necessary drivers, network stacks and component libraries through the Amazon FreeRTOS configuration”

In the future, there will be billions of devices connected to the Internet, so faster and more reliable data processing will become crucial. The reason why customers go to the cloud-based application is mainly based on the flexibility, convenience and cost considerations brought by cloud computing. Edge computing enables data to be processed at the nearest end and enhances the real-time control, which reduces the need to transfer data back and forth between the clouds. The MCU, as the core component of the edge computing technology, can control the entire data link from the device end to the cloud. So, we closely look at the future development in the Internet of Things field and continue to upgrade and enrich the software /hardware ecosystem.

About AWS

Amazon Web Services (AWS) is Amazon’s cloud computing platform that provides individuals, organizations with comprehensive, on-demand and secure cloud services to build, enhance, and promote business applications. AWS provides a wide range of very useful service packages that can generate highly dynamic applications when collaborating with each other and working together. AWS enables users to use its wide range of products to create applications on the cloud, store data on the database cloud, distribute and deploy applications on cloud servers.

About GD32 MCU

GigaDevice GD32 MCU is a leader in China’s high-performance 32-bit general-purpose microcontroller market being the first to release China’s Arm® Cortex®-M3, Cortex®-M4 and Cortex®-M23 core MCU product series. GD32 series MCUs have become the mainstream choice for China’s 32-bit general-purpose MCU market. With the current GD32 MCU product portfolio, which consists of 24 series and over 350 part numbers, has shipped more than 300 million units to over 20,000 customers. GigaDevice can provide solutions for a broad set of applications at the forefront of the market. GigaDevice GD32 MCU is also the first Chinese Arm® University Program (AUP) partner, an Arm® mbed™ IoT platform eco-partner. All MCUs are compatible with each other in terms of software with scalable performance in different hardware packages. The MCUs can be used in a wide variety of embedded systems ranging from high-performance to entry-level applications, enabling developers to build a comprehensive ecosystem with a solution that combines value and ease of use.

Chipmaker GigaDevice Semiconductor (Beijing) Inc. has received the green light to raise funds for construction of a new factory making DRAM chips, joining a fledgling campaign by local Chinese players aiming to enter a lucrative sector dominated by foreigners.

GigaDevice’s drive into memory also comes as China tries to build up its own chip sector to lower its reliance on dominant players, mostly based in the U.S., Europe, Japan and South Korea. That reliance came into focus last year when the U.S. banned Huawei Technologies from buying many American-made parts, including telecom chips, dealing a major blow to the local tech giant.

GigaDevice said it plans to raise up to 4.32 billion yuan ($611 million) through a private placement of new shares to fund the move into DRAM, one of two major types of memory chips that power smartphones, PCs and other computing devices. It said the securities regulator approved the new share issue last Friday, according to its Tuesday announcement (link in Chinese) to the Shanghai Stock Exchange.

Most of the funds raised would be used to develop new DRAM chips and eventually produce them, GigaDevice said. It added the private placement would go to up to 35 investors, including fund managers, brokerages and other financial institutions. It said the number of new shares would be equal to up to 20% of the company’s total count.

GigaDevice first announced its intent in March, saying its plan would cost about 4 billion yuan, with 3.3 billion yuan of that to be used on DRAM development and mass production.

Most of the world’s DRAM and NAND, the other major kind of memory, are currently produced by South Korea’s Samsung and SK Hynix, as well as U.S. producer Micron Technology, which collectively control 90% of the global market. All three global leaders are now producing chips in the 12 to 19 nanometer (nm) range, while GigaDevice aims to develop its first chips in the 17 to 19 nm space. The smaller the chip’s specification, the more circuits and memory capacity that can be packed onto its surface. GigaDevice intends to wrap up its design and production planning this year, and complete customer validation and start mass production next year.

In addition to its own DRAM plans, GigaDevice is also an investor in ChangXin Memory Technologies Inc., one of China’s other major companies exploring DRAM production. ChangXin is already producing DRAM chips and has invested 15 billion yuan in the campaign, with plans to build out its production in three stages.

A third player, Tsinghua Unigroup, has also been putting resources into DRAM development. The company announced the establishment of a DRAM working group last June, and later said it would set up its production base for the product in the southwestern city of Chongqing. It said it planned to start construction on its facility at the end of last year and start producing chips in 2021.

But simply wanting to produce such high-tech chips may not be enough for China to quickly become a player, since such production requires sophisticated proprietary technology that China now largely lacks, observers have noted. Even before the current Covid-19 outbreak shut down much of China for more than a month, aspiring chipmakers were finding that their pockets were simply not deep enough to build a competitive chipmaking industry from scratch, despite stretching their budgets to the breaking point.

The Shanghai Stock Exchange Sci-Tech Innovation Board, also known as the Star Market, is about to welcome another microelectronics company – Giantec Semiconductor (聚辰半导体, A19012:SH). Meanwhile, the number of stocks listed on China’s new Nasdaq-style platform is growing: fifty-six firms have already completed their public offerings, with a dozen more currently preparing to kick off trading.

Giantec is another Shanghai-based semiconductor firm that is willing to dip its toe into the local capital market’s waters. Founded roughly 10 years ago, it has grown into one of the most significant providers of electrically erasable programmable read-only memory (EEPROM) chips – microdevices that are typically used to store configuration parameters in personal computers and other intelligent tools of the digital era. These tiny things loom large in the company’s output structure, accounting for 88.4% of its operating income in the first half of 2019.

Smart card chips and driver integrated circuits (IC) for voice coil motors can also be found in Giantec’s product mix. Together with the rest of the chipmaker’s non-EEPROM devices, they have netted CNY 167.18 million (USD 23.79 million) over the past three years. Both the absolute figures and the relative weights of these two types of chips in the company’s financial results have been declining steadily, with the main product line boosting its total value from CNY 239.59 million (USD 34.09 million) in 2016 to CNY 385.52 million (USD 54.85 million) in 2018.

Gigadevice (603986) 2019 1H performance beats expectations, product line is constantly growing.

兆易创新(603986)19H1业绩超预期,产品线不断丰富

圣邦股份(300661)2019年中报点评:电源管理及钰泰TWS产品驱动,业绩超预期增长

北京君正(300223.SZ):公司半年报业绩亮眼,并购矽成有望加大业务布局

集微网消息 近日,江苏卓胜微电子股份有限公司(以下简称“卓胜微”)在证监会网站披露招股书,公司拟在创业板公开发行不超过2500万股新股,发行后总股本不超过1亿股,保荐机构是中金公司。

自成立以来,卓胜微始终致力于射频前端芯片的研究、开发,主要向市场提供射频开关、射频低噪声放大器等射频前端芯片产品,并提供 IP 授权,应用于智能手机等移动智能终端。

卓胜微在射频芯片领域获得了深厚的技术积累和高效的研发团队。截至 2018 年 3 月 31 日,卓胜微总人员为 102 人,其中研发人员达到 56 人,占比 54.90%。截至本招股说明书签署之日,已取得 50 项专利(其中发明专利 46 项)、 9 项集成电路布图设计。

目前卓胜微已成为国内智能手机射频开关、射频低噪声放大器的领先品牌,卓胜微的射频前端芯片应用于三星、小米、华为、vivo、OPPO、联想、魅族、TCL 等终端厂商的产品。

报告期内,卓胜微自2015年起扭亏为盈,业务规模实现快速增长,2015-2017年及2018年一季度,卓胜微实现营业收入1.11亿元、3.85亿元、5.82亿元和1.28亿元,归属于母公司股东的净利润分别为1125.22万元、8415.94万元、16988.84万元和2414.81万元。

招股书显示,卓胜微IPO拟募集资金约12亿元,募集资金拟投资于“射频滤波器芯片及模组研发及产业化项目”、 “射频功率放大器芯片及模组研发及产业化项目”、 “射频开关和 LNA 技术升级及产业化项目”、 “面向 IoT 方向的 Connectivity MCU 研发及产业化项目”和“研发中心建设项目”。

卓胜微表示,本次募集资金投资项目若能够顺利实施,将进一步增强研发实力、提升现有产品性能、丰富产品体系;可实现对射频滤波器、射频功率放大器进行开发,完善公司在射频芯片领域的产品布局;在现有产品基础上开发面向物联网的微控制器芯片,不断丰富公司业务线,从而进一步提高盈利水平,持续增强公司整体竞争能力。

品质or性能,如何打入三星供应链?

卓胜微电子的实际控制人是许志翰、Chenhui Feng(冯晨晖)和 Zhuang Tang(唐壮)合计控制该公司48.24%的表决权。其中,董秘冯晨晖和唐壮是美国国籍。冯晨晖是现任公司董事、副总经理、董事会秘书。唐壮现任公司董事、副总经理。

据悉,许志翰是清华大学计算机科学与技术专业学士、硕士研究生。曾任东芝美国分公司工程师,美国 ATOGA Systems 公司主任工程师,杭州中天微系统有限公司副总经理,杭州赛安微系统有限公司副总经理。现任任卓胜上海董事长、总经理。

许志翰近日在第二届集微半导体峰会供应链沙龙上讲述了一段卓胜微的创业史,他表示,卓胜微是一个很“苦逼”的芯片公司,12年前公司刚开始创业,是从手机电视芯片做起,那时候“光有雷声,没有雨点”,手机从2G向4G升级转型,没有人在去看CNB,也不再需要模拟电视。

这样的情况让卓胜微在2010年经历了非常痛苦的转型,转型时,卓胜微团队思考了两个问题,智能手机需要什么?未来好的手机需要什么样的技术?所以卓胜微在2010、2011年的时候,转型做手机的射频芯片。

许志翰表示,转型做手机射频芯片也有一些巧合,卓胜微碰到的第一个客户就是三星,因为三星在电视年代,就使用了卓胜微的CMB芯片,所以卓胜微成了三星的合作供应商。

在琢磨三星手机需求的同时,卓胜微抓住了一个很好的时间点,手机从功能机往智能机转型,比如说GPS是一个标配型的产品,但是GPS芯片面临着一个大的变化格局,那个时候的GPS芯片,全是那些欧美大厂自产自销,他们的产能很有限,有很特殊的工艺,所以当时卓胜微做了一些创新和努力,解决了三星缺货的问题。

许志翰表示,新兴行业在过去的5年、10年发生了很大的变化。10年前,整个行业有非常多山寨企业,引导的驱动是成本,就是不断的降价。如今来看,降价带来的,要么就是牺牲性能,要么就是牺牲品质。

在当今这个年代,做芯片产业的伙伴们,要聚焦到好的品牌客户,好的合作伙伴,要做出高品质、高性能,能够给终端合作伙伴带来价值的产品,如果真有这样的耐下心来好好做的东西,它的前景一定会美好。

取得行业有利地位,竞争瞄向Skyworks

据招股书披露,2015 年度、2016 年度、2017 年度及 2018 年 1-3 月,卓胜微公司毛利率分别为 56.80%、 62.11%、55.89%及 53.68%,维持在较高水平,但市场竞争日益加剧。

现阶段,全球射频前端芯片市场主要被 Broadcom、Skyworks、Qorvo 等国外企业占据。他们拥有较强的资金及技术实力、较高的品牌知名度和市场影响力,与之相比,本公司在整体实力和品牌知名度方面还存在差距。

国内竞争厂商主要有锐迪科、国民飞骧、唯捷创芯等。本土竞争对手提供的芯片产品趋于同质化,从而导致市场价格下降、行业利润缩减等状况。同时,随着智能手机、平板电脑的性能差异逐渐缩小,下游市场竞争激烈,下游企业毛利率出现下降趋势,也可能导致行业内设计企业利润空间随之缩小。

2015 年度、2016 年度、2017 年度和 2018 年 1-3 月,卓胜微的主要产品射频开关平均单价分别为0.4089元/颗、0.4619元/颗、0.3372元/颗和0.2841元/颗;射频低噪声放大器的平均单价分别为0.2519元/颗、0.3474元/颗、0.2678元/颗和0.2137元/颗。

值得注意的是,2015-2017年及2018年一季度,射频开关和射频低噪声放大器收入占卓胜微营业收入的比重分别为88.52%、97.09%、97.62%和97.96%。

时至今日,国内射频前端芯片也开始了价格战,很多企业还是靠成本驱动发展。而就目前来看,卓胜微在这次战役中,明显取得了有利地位,行业竞争开始瞄向Broadcom、Skyworks、Qorvo 等国外企业。

IP 授权给展锐/Cypress,小米成第二大客户

事实上,卓胜微除了向市场提供射频开关、射频低噪声放大器等射频前端芯片产品,还通过向第三方提供 IP 授权,向第三方收取授权及技术服务费、权利金。

卓胜微提供的 IP 主要是 WiFi、经典蓝牙和低功耗蓝牙的射频设计 IP,以及部分调制解调器设计 IP。主要客户包括紫光展锐(原“展讯通信”)、Cypress、WiPAM、山景股份、飞索半导体、中芯国际、炬力、安徽华语及其关联公司 Sunrise、国民技术。

值得注意的是,山景股份的主营业务为微控制器(MCU)芯片的设计、开发和销售,产品主要应用于音频、物联网及智能控制等市场。卓胜微拥有山景股份生产所需的专有技术,对山景股份提供IP授权及服务。

为实现卓胜微蓝牙芯片领域和山景股份微控制器领域在技术和市场的协同效应2017 年 9 月,卓胜微通过受让股份及增资的方式取得山景股份 4,708,000 股股份, 占山景股份股本总数的 15%。

据悉,紫光展锐是卓胜微的第7大客户,原为卓胜微的股东。2017 年 7 月 27 日,展讯通信将其持有的卓胜有限 9.0827%股权(对应 111 万元出资额)以 18,544.0840 万元的价格转让给南通金信,紫光展锐不再持有卓胜有限股权。

值得提及的是,卓胜微境外收入占比较高,且金额呈增长态势,2015 年度、2016 年度、2017年度及2018年1-3 月公司营业收入中境外收入占比分别为 75.40%、80.26%、68.42% 及 67.37%,覆盖越南、韩国、香港、印度、印尼、美国、台湾等多个国家和地区。

这主要是由于卓胜微早已成为三星合格供应商,且是第一大客户。三星在印尼、越南、巴西、广东、天津等地区建立了生产基地,根据三星集团各工厂的生产计划,卓胜微在上述地区的出货量增加,营业收入也相应上升。

此外,小米对卓胜微的营收占比也在大幅增加,小米已经成为国内知名的移动智能设备生产商,卓胜微与其建立了稳固的合作关系,2017 年以来,小米已成为公司第二大客户。

SG Micro, China's leading high performance analog fabless company IPOed in Shenzhen stock Exchange

GigaDevice Semiconductor (Beijing) Inc. completed an initial public offering of A-share stocks on the Shanghai Stock Exchange on August 18, 2016.Company stock name: GigaDeviceStock Code: 603986

A-share capital: 100 million shares (including 25 million listed for trade)Supporting Quote:“Our initial public offering on the Shanghai Stock Exchange begins an important new chapter in the development of GigaDevice,” said Zhu Yiming, Chairman and CEO of GigaDevice Semiconductor (Beijing) Inc. “This successful public listing was made possible by the support of our partner ecosystem, the guidance and assistance of regulatory departments and government agencies, the efforts of our employees, and the trust and confidence of our investors and customers. I want to offer our heartfelt thanks to each and every one of these friends and colleagues for helping us attain this milestone. As a publicly traded company, we look forward to collaborating with our investors, partners and customers not only for our collective mutual benefit, but to also share a better tomorrow.”

About GigaDevice Semiconductor (Beijing) Inc. GigaDevice is a global R&D and chip design company headquartered in Beijing specializing in high-performance, low-power and cost-effective memory and controller solutions. The company’s lineup of products includes code-type flash memory, data-type flash memory and microcontrollers. Our technologies are in wide global use in applications ranging from mobile devices, personal computers and peripherals, networking and telecommunications equipment, medical devices, automotive electronics, industrial automation systems and more. GigaDevice is committed to the success of our customers through continuous innovation, in-depth research and quality design and development.

Stanford engineers find that a new Visit us at Electronica 2016 in Successful A-share Listing of GigaDevice will be in the 2015 GigaDevice: Top 5 China IC GigaDevice GD32 MCU Online GigaDevice GD32 MCU will be in GigaDevice Attend 2013 “Cloud, IMETU & GigaDevice Jointly GigaDevice GD32 MCU officially

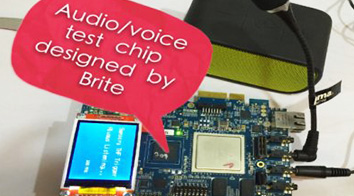

The Audio/Voice DSP Reference Design Platform, developed based on a CEVA-TeakLite-4 DSP core, combines multiple sensing, processing and connectivity technologies, enabling rapid system prototyping for mobile, wearable and smart home to reduce risks and time-to-market of SoC designs.

Brite Semiconductor is a rapidly emerging ASIC design services company providing customers with ASIC/SoC chip design and manufacturing services. The company was co-founded by Semiconductor Manufacturing International Corporation and Open-Silicon, as well as venture capitalist firms from China and Silicon Valley. As strategic partners, SMIC provides Brite Semiconductor strong technical and manufacturing support and leverages Brite’s design capabilities in test chip development. Targeted at advanced processing nodes to 28nm with high-end SoC design services, Brite Semiconductor provides customers with flexible design and turn-key services. Brite offers customers RTL/netlist to seamless chip delivery with enhanced economic value for low-risk solutions. For more information, please refer to the Brite Semiconductor website at www.britesemi.com.